In the previous blogs in our five-part blog series, Cash Management in a Digital World: Today’s Landscape and What’s on the Horizon, we focused on the aggregate results and implications of the Cash Management in a Digital World survey, and industry-specific blogs focused on manufacturing, healthcare, and commercial real estate companies. Here, we’ll analyze the results from treasury professionals working for higher education institutions.

The top cash management challenges faced by treasury teams in higher education are:

- Visibility into bank account activities

- Lack of cash forecasting speed

- Difficulties in collaboration with accounts payable (AP) and accounts receivable (AR)

Among survey respondents, thirty-four percent (34%) of treasury teams in higher education identified problems with visibility into bank account activities significantly more often than treasury teams in transportation/logistics (15%), manufacturing (12%), warehousing (12%), and commercial real estate (6%) companies. This result is not surprising given that 37% of institutions surveyed have more than 26 bank accounts, 20% have more than 100 bank accounts, 42% have bank accounts in at least six different countries, and only 14% have daily visibility into more than 90% of bank accounts. This data suggests that treasury teams in higher education might not have access to the right technology. Relying on spreadsheets as the primary cash management tool often inhibits effective bank relationship management, causes inefficient cash forecasting, and generates cash management silos.

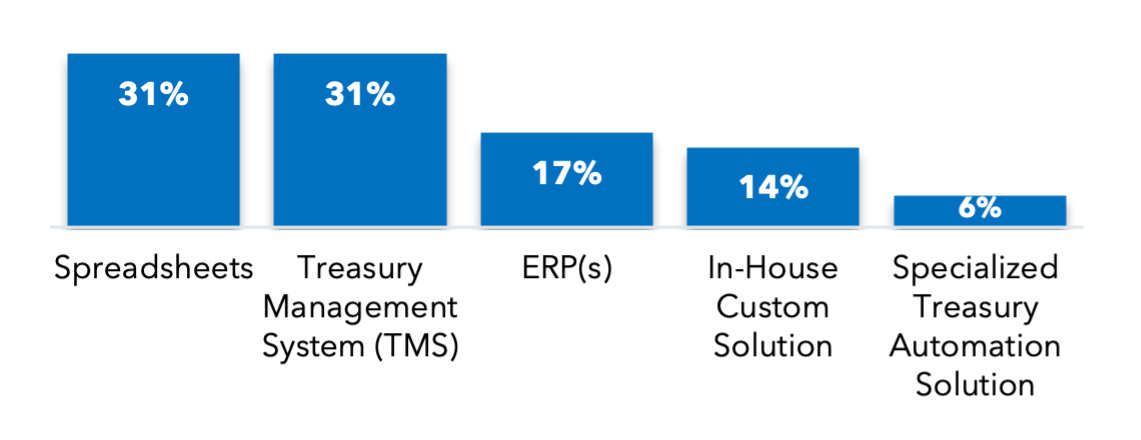

Figure 1. Primary Tool Being Leveraged in Managing Cash

The use of spreadsheets as the primary cash management tool is prevalent by treasury teams in higher education institutions (31%). This indicates that technology may not be a priority, and may help explain the difficulties faced in bank account visibility. Investing in technology that delivers timely bank account activity for all bank accounts represents an area of opportunity for higher education treasury leaders to explore and may offer low-hanging fruit to impact the bottom line.

Difficulties in collaboration with accounts payable (AP) and accounts receivable (AR) by treasury professionals in higher education may be driven by silos between the treasury team and their counterparts in AP and AR. Sixty percent (60%) of higher education treasury professionals reported that their treasury and AP teams work in silos, and forty percent (40%) reported that treasury and AR work in silos. 29% shared that silos exist within their own treasury team as well.

The higher education institutions surveyed will invest in the technology and people they believe will impact the strategic value delivered by their treasury teams in 2025, with two-thirds (66%) of institutions indicating they will upgrade cash management-related technology in 2025. A blind spot that these institutions would also do well to address is the existence of silos within their treasury teams and between treasury and AP, treasury, and AR.

Higher education institutions have also been investing in AP automation solutions with greater frequency, since these tools can help mitigate and eliminate cash management challenges. They do so by:

- Giving AP staff more time to focus on strategic activities, such as facilitating collaboration with their treasury colleagues, negotiating vendor contracts, and working on financial analysis, budgeting, and planning.

- Eliminating silos of information between suppliers and AP teams and delivering a vehicle for real-time collaboration – both of which improve supplier relationships. This translates into lower payment processing costs and more control over the type and timing of payments.

- Supporting company growth and strategic agility. Once AP automation is in place, increasing AP volume, changing headcount in AP, addition of new entities, and growing operational complexities become less worrisome.

A key pillar of cash management success for treasury teams is communicating and collaborating with AP team members to make data-driven decisions about how and when suppliers are paid in a secure environment. The right technology empowers this.

You can discover more about the AP Automation ROI for higher education institutions in this AP Automation Cheat Sheet for Higher Education and the Handbook for Modernizing AP in Higher Education.