Benefits to Corporate Customers of Using SWIFT

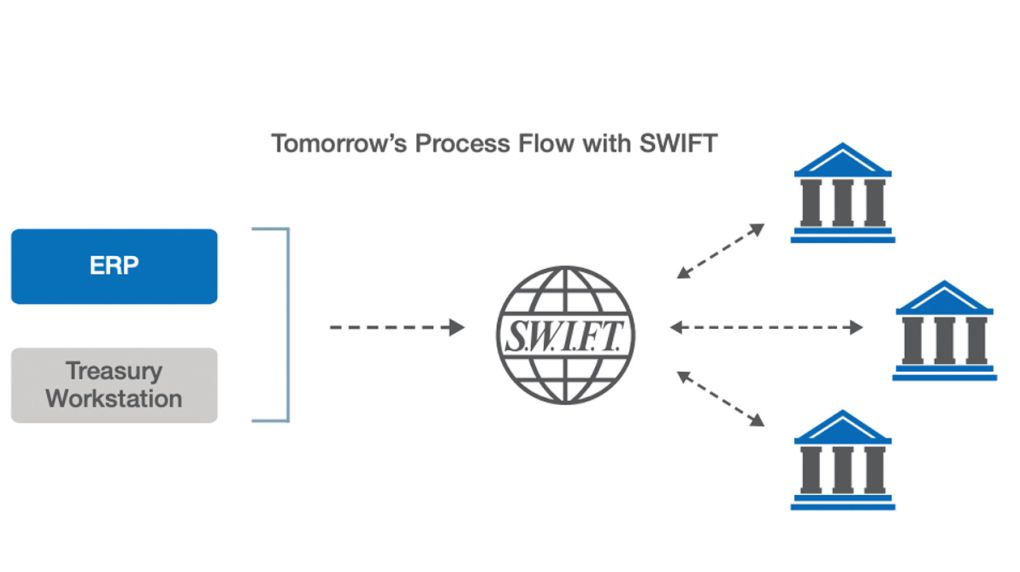

Using SWIFT, companies are able to consolidate the many steps and processes

associated with financial messaging for both inbound activities, such as bank balance and transaction reporting, and outbound activities, including payments, securities and FX confirmations. It also standardizes security requirements including encryption.

This enables corporates to dramatically streamline processes and connectivity as well as normalize formats to create a more efficient payment and cash management environment. The result: Treasury can now focus on working capital optimization with more confidence in the accuracy and timeliness of information.

- Global Visibility to Cash Positions

- Improved Transactional Standardization

- Improved Regulatory

- Increased Security and Reliability

Is SWIFT Right for Your Organization?

It is a widespread misconception that SWIFT access is only for Fortune 500 and FTSE 1000 organizations. This is no longer the case. Recently, the profile of corporations on SWIFT has expanded to include those midsize companies with increasingly complex payments and cash management requirements.

The reason is twofold. First, the trade supply chain (buyers, vendors, manufacturers, etc.) is moving to a global model, even for small to midsize companies. As the trade supply chain becomes more international, the financial supply chain must follow suit in order to efficiently make payments and manage cash positions internationally. Second, the emergence of SWIFT service bureaus has dramatically reduced the cost and complexity of connecting to SWIFT. In the past, SWIFT access required establishing a direct connection, which represented a substantial investment in time, hardware, software, communications, training and in-house expertise. A SWIFT-certified service bureau reduces up-front investment costs, speeds implementation and eliminates the need to have SWIFT specialists on staff. It’s no wonder that 80 percent of new corporates connect to SWIFT via a service bureau. While each corporation needs to closely examine their banking, payment, and cash management requirements, SWIFT can provide a cost-effective solution to two of the key factors driving complexity:

- Managing multiple domestic and international banks

- Handling multiple domestic and international payment types

Building a Business Case

If you are considering implementing SWIFT in your organization, it is recommended that you develop a business case that will help you understand your total cost of ownership (TCO) now and after the adoption of SWIFT. It will also help you calculate your potential return on investment. Here’s how:

1. Understand your total cost of ownership today.

Start by compiling a TCO of your current payments and cash management environment. Build a model of work hours spent and the fixed costs associated with bank connectivity and cash management today. To do so, you will need to identify costs for both the infrastructure and the resource teams needed to support your operation. This can include the cost of:

- Connecting to, and getting the information needed, to and from each bank

- Operational people needed to manage each of your bank connections

- Training of analysts who use different bank workstations

- Time spent consolidating information and providing Treasury the information they need

- Ensuring back-office systems are maintained as bank and regulatory requirements change.

2. Identify costs that will be eliminated by SWIFT.

Next, determine the areas, and their associated costs, that will be eliminated by using SWIFT products and services.

3. Include additional savings.

In addition to easily identifiable quantitative benefits, there are other savings that are important but more difficult to quantify. These include:

- Improved control over the payment initiation process

- Elimination of errors and “re-work” associated with manual processes

- Savings from global visibility to cash, ensuring working capital optimization

- Transaction processing efficiencies that help minimize risk and ensure regulatory compliance

- Interest earned because payments can be released on a schedule that optimizes liquidity management

The effect of these qualitative, or “soft,” benefits should be incorporated into your

business case in order to provide a complete picture of the overall positive impact that adopting SWIFT can have on your organization.

Subtract the cost reductions and anticipated savings from SWIFT (identified in steps two and three) from your current-state TCO determined in step one.

4. Add the costs associated with adopting SWIFT.

The costs associated with SWIFT can include registration, messaging, project

management and application integration.

Add this to the total you calculated after step three to determine the projected TCO after SWIFT is adopted.

Selecting a SWIFT-Approved Service Bureau

While there are multiple ways to connect to SWIFT, the majority of corporates that join SWIFT do so through a service bureau. That’s because a SWIFT service bureau eliminates operational costs, infrastructure complexities and the need to maintain in-house SWIFT expertise. It also dramatically cuts the time required to initiate SWIFT services. All SWIFT service bureaus are not created equal. Here are some important things to consider when selecting a SWIFT access partner:

- How long has it been in the business?

- Does it offer a full portfolio of SWIFT products and services?

- Does it have an accredited team of SWIFT experts?

- Does it provide support and training tailored to your needs?

- How much operational experience does it have?

- Does it have a multi-site infrastructure with the highest level of security and resilience?

- Is its access service scalable and flexible enough to support your organization now and as requirements and volumes expand?

Will it support changes generated by evolving SWIFT and bank-specific requirements?

Carefully considering the responses from prospective vendors regarding the issues posed by these questions can help ensure that you derive the maximum benefits from SWIFT utilization.

Summary

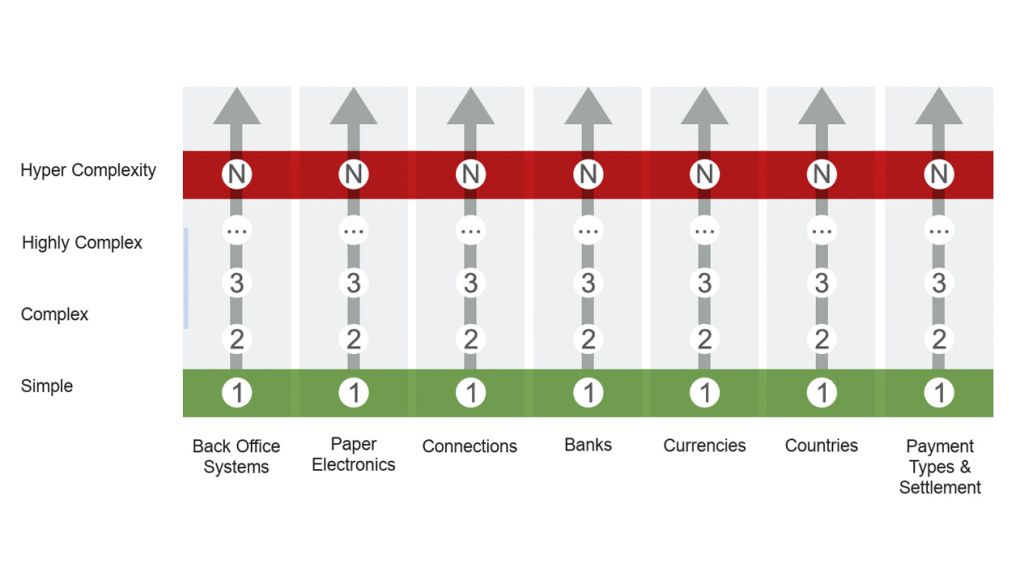

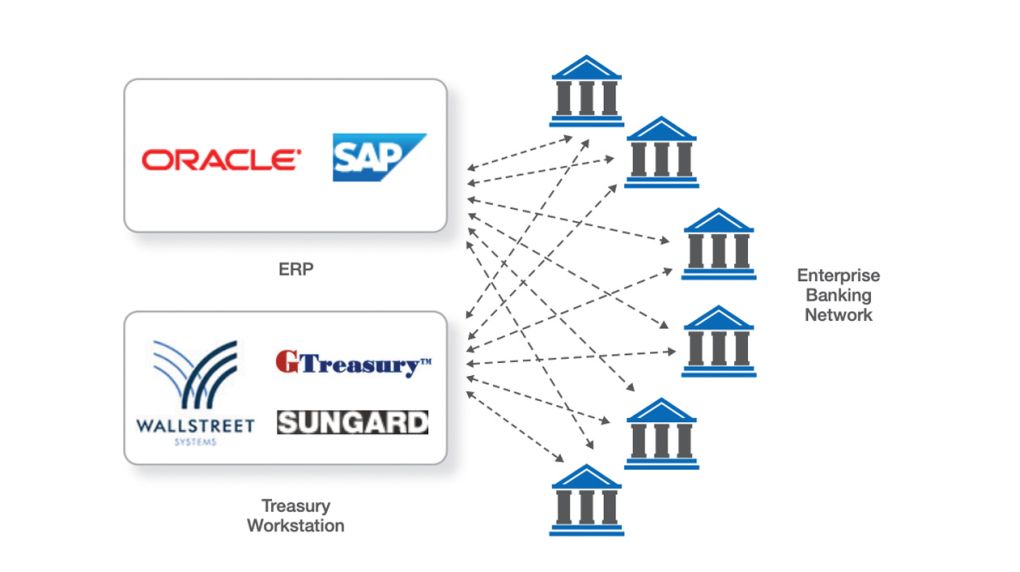

Payments and cash management have become complex, costly and cumbersome for corporations with multiple domestic and global banking partners. Today, most corporates still communicate with their banks point to point, dealing with each as a separate entity.

Coordinating multiple bank communication channels leads to a number of significant challenges, since each bank has different format, connectivity and security requirements. Furthermore, each payment and transaction type may have its own set of requirements, not only for each bank but also within different data centers of the same bank. This multiplicity of requirements places a heavy burden on your staff as well as on your back-office ERP, treasury, and legacy systems, which have to stay in sync with each bank’s standards and protocols.

SWIFT offers a compelling financial supply chain solution that can link corporates and non-banking financial institutions to banks and other financial institutions around the world. With its highly secure, standardized communication platform, SWIFT lets corporations replace multiple standards and protocols with standardized message and file structures that reach all their financial services partners. As a result, communication channels are streamlined and organizations benefit from improved management of working capital and increased operational efficiency and productivity.

Developing a formal business case will help you understand your total cost of ownership and your potential return on investment. It will identify duplicate processes that can be eliminated once SWIFT is adopted, including the costs for redundant communications and security requirements, training, operations, and maintenance. It will also help you identify other benefits such as the cost savings that can result from global visibility on cash, increased security and improved compliance.