8. Works with your other virtual card programs

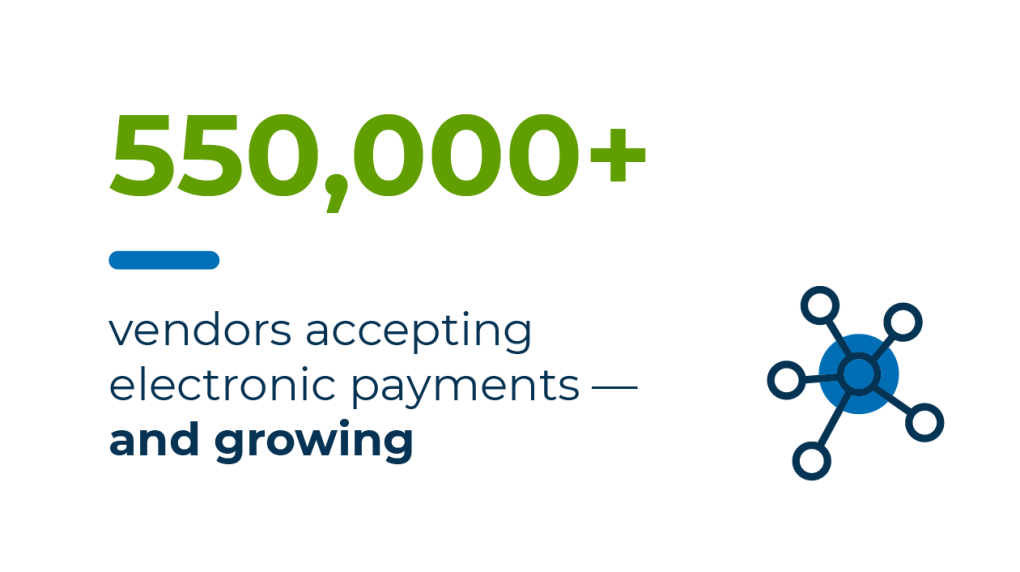

We understand that you may already have a payments program with your bank. Keep existing card programs in place and expand it with Paymode payments automation. You'll add more vendors who can receive electronic payments, automating more of your processes and improving your payments security.