Customer experience

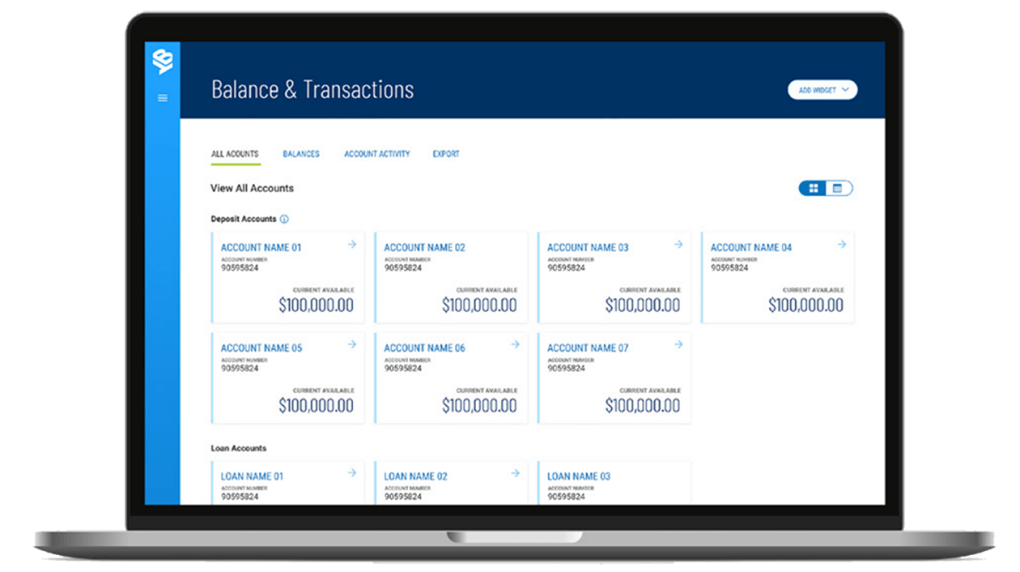

- Superior user interface and simple workflow navigation

- Personalized workspace

- Drag and drop features

- Mobile responsive design and mobile app

Welcome to Your Intelligent Engagement Platform

The intelligent commercial bank platform for an insanely great commercial banking experience is here. Businesses want consistency with their retail banking experience and you need to drive intelligent engagement to deepen and grow those relationships.

It all starts with payment innovation for your small, midsize and corporate business customers that allow you to evolve into an intelligent business enabler. Seamlessly integrate into your core banking system with simple workflow navigation, drag and drop features and mobile responsive design — and that’s just the beginning.

Your commercial banking transformation starts here.

Through Digital Banking IQ, commercial banking is made easy for small to midsize business customers as well as large corporations so they don’t have to be banking experts.

Featuring a powerful combination of world-class payments and cash management services, rich features and advanced technologies, you will position your bank as an intelligent business enabler.