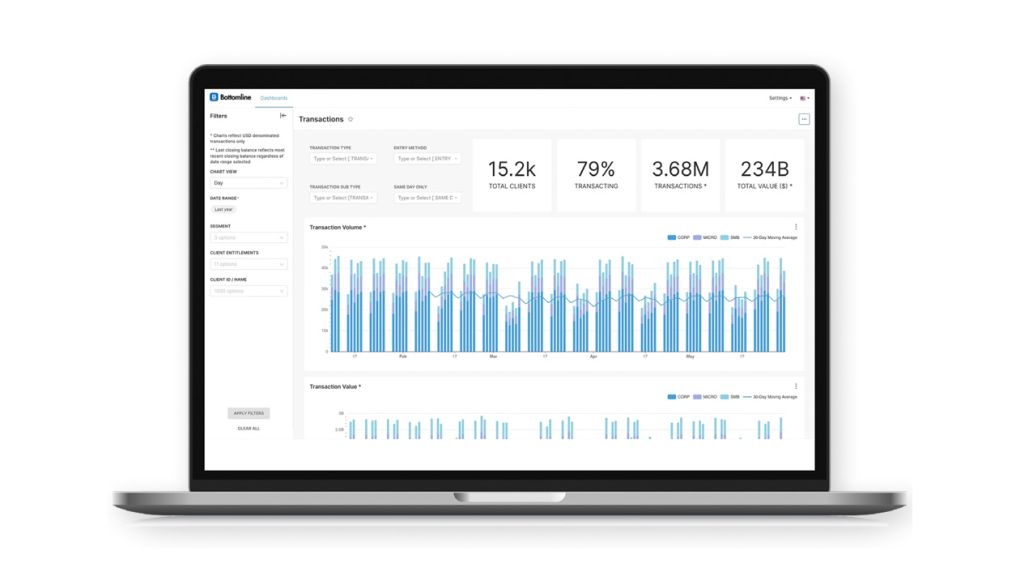

Engagement Optimizer provides additional insight into your business customers activity, going beyond traditional reports. This solution helps identify any emerging potential risks or growth opportunities for each individual customer. Plus, you can enhance this reporting even further with the Salesforce connector which allows your bankers to monitor their customers activities.

Whether your bank is managing the migration of new business customers onto the Commercial Digital Banking Platform, helping your bankers identify emerging risks and growth opportunities within individual client relationships, or tracking the impact of digital engagement on overall relationship value over time, Engagement Optimizer provides the timely insight your Treasury team and bankers need to manage their client portfolio more proactively and effectively.