Monitor All Types of Payments

Secure Payments monitors trillions of transactions worldwide. View any outgoing payment via Card, Check, ACH, Wire, SWIFT, FileAct, SEPA, SIC4, ACH, Fedwire, Check, ISO200022 and ISO8583.

Industry-standard integration into payment systems

Configurable out-of-the-box libraries with proven best-practice fraud risk indicators

Speed investigations through visual link analysis and Record and Replay

Payments can be instantly blocked to prevent fraud loss

Secure Payments monitors trillions of transactions worldwide. View any outgoing payment via Card, Check, ACH, Wire, SWIFT, FileAct, SEPA, SIC4, ACH, Fedwire, Check, ISO200022 and ISO8583.

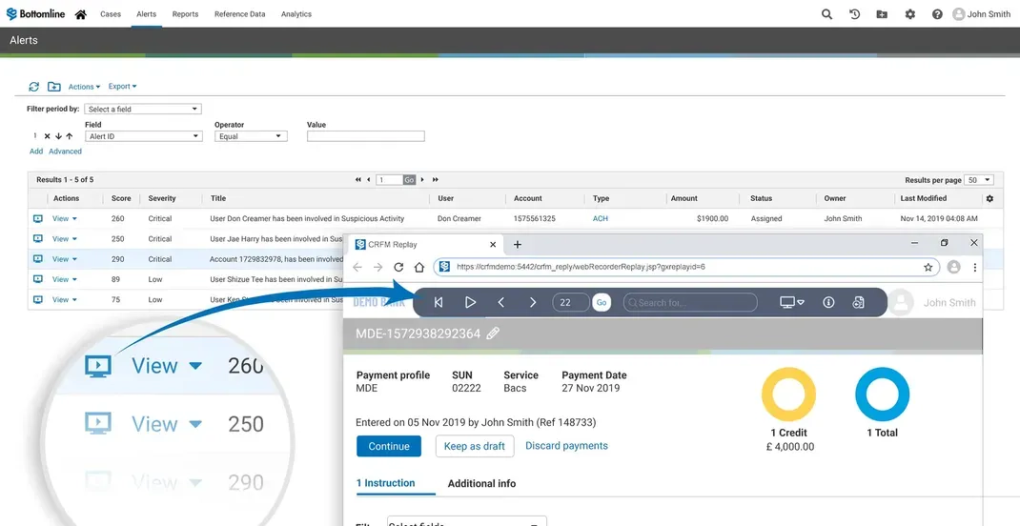

Assess alerts and act on the ones that concern you the most. Bottomline organizes alerts based on an intelligent machine-learning engine and adapts them based on how you’ve resolved them in the past. So, you’re focusing on where your organization is at risk.

Bottomline automatically puts transactions on hold, allowing suspicious events and high-risk payments to be examined in the Alert Investigation Center. Connect the dots easily between users, accounts, transactions, and a plethora of data to get a fuller understanding of the risks. Once the investigation is complete and funds are verified, analysts can release funds or block them if determined fraudulent.

No dependency on data availability and quality in log files. With Record and Replay, security teams can review end-user activity and examine the evidence to understand the sequence of events

Identify unusual behavior from insiders or intruders before their high-risk activities disrupt your business.

Organize, prioritize, and manage investigations by aggregating data from all your risk detection solutions into a centralized tool.